The Power of Knowing

At Wealth Management of Kentucky, we believe the first step on the path to success is equipping your investments with our investment methodology known as Market Guard®.

Market GuardTM

The Market Guard® investment methodology was created with one simple concept in mind: to help empower clients with the highest probability of investment success while helping to protect their investments along the way.

At Market Guard®, we strive to understand the challenges that investors face on a daily basis. Therefore, the Market Guard® investment methodology was created with an intelligent approach to achieve the level of success we believe every investor deserves.

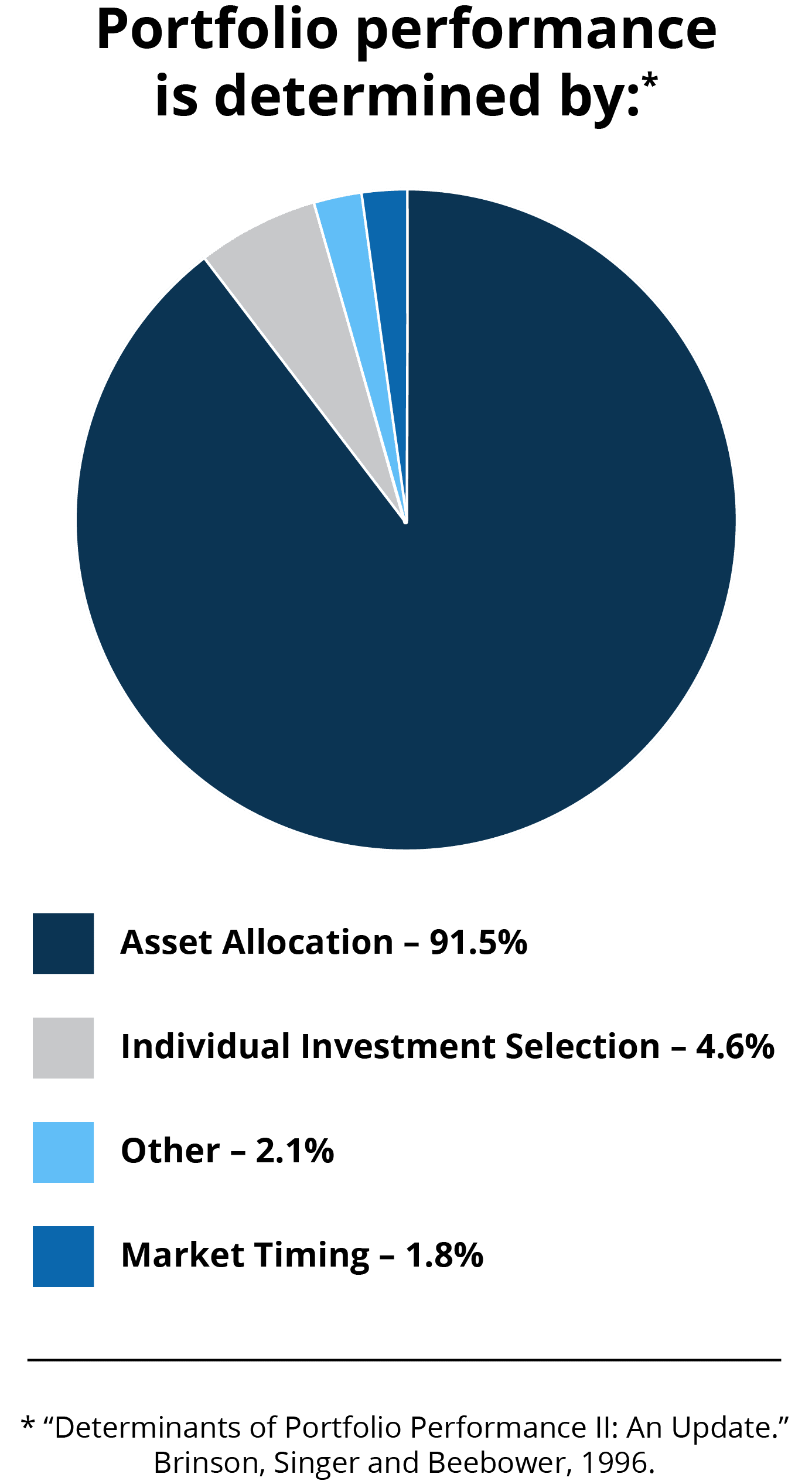

When it comes to portfolio construction, research shows that asset allocation can be one of the most important factors to influence overall performance. According to multiple academic studies, more than 90% of a portfolio’s success is determined by asset allocation. In addition, determining the correct investment classes, as well as the proper percentage to hold in each portfolio, is paramount to long-term success.

Intelligent Performance

Market Guard® seeks to generate Intelligent Performance by dedicating relentless effort to innovation, values, and excellence. These characteristics are at the core of our Tactical and Strategic Asset Allocation model portfolios. When constructing these model portfolios, we start by selecting the individual securitie and then determining the appropriate allocation within each specific portfolio. Once this process is complete, we recognize the importance of personalization to the individual investor in order to help them achieve their specific goals. For this reason, Market Guard® provides the capabilities to allow the investor to tailor the exact blend of equities and fixed income desired.

Market Guard® Tactical & Strategic Asset Allocation

Step 1: Evaluate, select, and implement individual investment positions to create a globally diversified portfolio.

Step 2: Determine the optimal asset allocation among the individual investment positions.

Market Guard® also offers enhanced monitoring within the Tactical Asset Allocation model portfolios. These are active management strategies that shift the percentage of assets held in various categories to mitigate volatility or take advantage of strong market sectors. Within these active management strategies, Market Guard® provides multiple options for further customization of tactical management style to fit an investor’s individual investment goals and risk tolerance in each separately managed account. To help provide the basis to perform these important investment decisions, Market Guard® utilizes a specific blend of technical indicators, fundamental analysis, and market observation.

Market Guard® Tactical Asset Allocation

Step 3: Utilize a non-emotional, methodical, mathematical approach to assess the individual positions in the portfolio, to signal a possible opportune time to HOLD, SELL, or BUY the underlying investment position.

- When to Hold: Market Guard® will assess the individual positions in the portfolio. If there are no signals to sell or buy particular investment positions, the allocation will remain unchanged. Based upon the analysis of current market conditions, we will validate the decision to hold the current portfolio allocation.

- When to Sell: Market Guard® will assess the individual positions in the portfolio and signal a possible opportune time to sell. Based upon the analysis of current market conditions, we will determine the quantity of shares to sell in an effort to help protect from unnecessary losses and volatility.

- When to Buy: Market Guard® will assess the individual positions in the portfolio and signal a possible opportune time to invest. Based upon the analysis of current market conditions, we will determine the quantity of shares to purchase.

Other important aspects that are a part of the overall strategy and design of Market Guard’s portfolio design are:

Intelligent Asset Allocation

Research shows that asset allocation can be one of the most important factors to influence overall portfolio performance. According to multiple academic studies, more than 90% of a portfolio’s success is determined by asset allocation. How a portfolio is rebalanced, and when, contributes to this success. Market Guard® portfolios take into account both downside risk and upside potential. Your money is too important to invest without an intelligent asset allocation that takes into account multiple factors and the potential outcomes that may be presented.

Monitor and Rebalancing

Market Guard® regularly reviews and monitors the investments selected inside the portfolios. Changes to the individual securities within the asset classes are executed when market conditions, technical indicators, or portfolio drift indicates. When we believe it is advantageous, a portfolio will be rebalanced, directing positions into undervalued asset classes and shrinking from overvalued asset classes.

Total Investment Liquidity

Life’s unpredictability demands flexibility. Market Guard® portfolios are designed to provide investment liquidity in the event of unexpected financial obligations, real-time emergencies, or just the desire to access your funds.